What Is the Right Time to Buy a Private Jet?

Jan 16, 2021

Market Conditions & Affordability

The inevitable first question is whether you can afford it. If you’re new to the private jet buying experience that’s a big question. Prices for new jets can range from $1.69 million to several hundred million for those who want to deck out a commercial-size plane to fit their own preferences. However, if you buy a larger jet, you might be limiting your destination options as not all small airports cannot properly accommodate commercial-sized jets.How Much Does It Cost To Buy A Private Jet?

Private jets start at an average of $3 million although you can find options for under $2 million. Prices can soar to $90 million and beyond depending on the size and customization. Buying a pre-owned private jet can cut down costs while still providing the benefits of flying privately.

Private jets start at an average of $3 million although you can find options for under $2 million. Prices can soar to $90 million and beyond depending on the size and customization. Buying a pre-owned private jet can cut down costs while still providing the benefits of flying privately.

New vs Pre-Owned

There’s a good reason for many jet buyers to purchase second-hand aircraft. Not only are new jets expensive, but the average private jet owner replaces his or her aircraft about every 3 to 5 years. It’s no surprise that in 2015, 76% of aircraft bought globally were pre-owned despite only 11.5% of the total jets listed for sale that year being pre-owned. If you like the idea of a pre-owned aircraft, you can have your jet broker or management company locate the right one for you, so you don’t have to do it blindly. Just be sure to use caution and get things inspected thoroughly.Maintenance Expenses

After purchase, there’s the cost of ongoing management. On average, it may cost $700,000 to $4 million each year to own and operate an aircraft in the United States, although that amount can vary significantly based upon usage.Luckily, those estimated operating costs cover a comprehensive list of needs:- Hangar or office

- Hull Insurance

- Liability insurance

- Pilot and staff, and/or training

- Average maintenance, including parts and labor

- Fuel

- Landing fees

- Catering

Considerations When Buying a Private Jet

Private jets are in no way impulse buys. You’ll need to take a considerable amount of time to determine which private jet is right for you and if purchasing a private jet is even the best decision for your current situation. When buying a private jet you should consider the average number of hours you fly each year, the financial investment, how taxes will affect your purchase, and what your basic needs from a jet are.

Private jets are in no way impulse buys. You’ll need to take a considerable amount of time to determine which private jet is right for you and if purchasing a private jet is even the best decision for your current situation. When buying a private jet you should consider the average number of hours you fly each year, the financial investment, how taxes will affect your purchase, and what your basic needs from a jet are.

HOURS OF USE AND QUANTITY OF AVAILABLE AIRCRAFT

The General Aviation Aircraft Shipment Report (GAMA) cites 3250 planes and helicopters shipped worldwide in 2017, with a total of more than 15000 business jets shipped worldwide between 1994 and 2016. On average, business jets up to 25 years old may only have about 12,000 hours on them, and when they’re well-maintained aircraft can easily last for 25,000 hours.TAX BENEFITS

If you plan to use your jet primarily for business, there are some potential tax deductions that can help cushion the blow from the initial investment. Really though – they do more than cushion the blow. Historically, the IRS defined a private jet with a “useful life of 5 years,” in which time many owners do switch jets – but they don’t have to. The jet could potentially be used for several decades. This allowed some businesses to recover up to 70% of the jet’s initial cost within 3 years time, based upon a disparity between the asset’s real-life rate of depreciation and accounting. In addition, a “bonus depreciation” was possible to speed up defined depreciation rates upwards of 50%. However, as of the tax reform passed by the Trump Administration in late 2017, companies that buy private jets can now deduct 100% bonus depreciation for the aircraft. This means that after a business buys a private jet, it can deduce the full depreciation of the aircraft immediately, but it doesn’t increase the depreciation value itself. Keep in mind, these potential tax deductions don’t apply to recreational use of the aircraft.GLOBAL ECONOMY AND FUEL PRICES

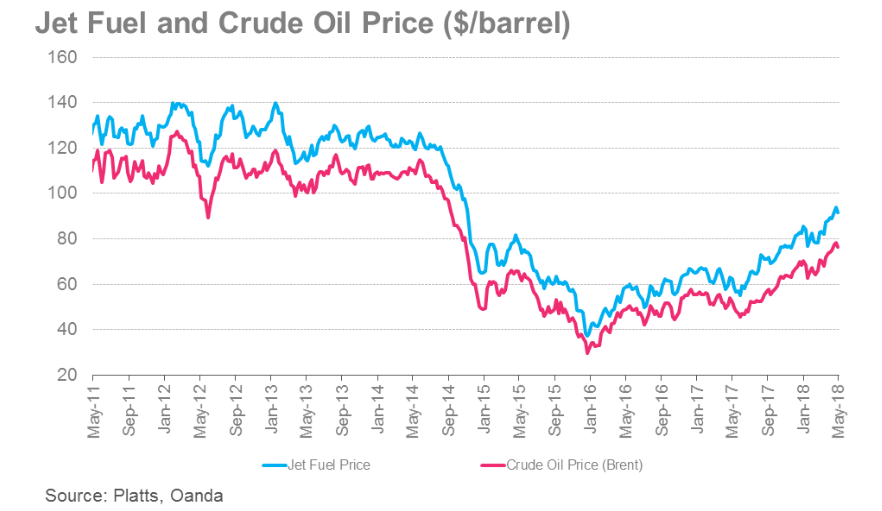

Gas prices are a consideration as well. According to the International Air Transport Association’s (IATA) jet fuel price monitor, prices may be higher than they were in 2016, but by comparison: The 2020 rate of $90/barrel of jet fuel is still way below the $130/barrel in May 2011.

Graphic created by Platts

HOW MANY HOURS FLOWN EACH YEAR

Recommendations can vary based on the purpose of use, the rates at your preferred charter company, market conditions, and more – but most prospective buyers should be flying at least 150 to 250 hours per year before considering private aircraft purchase. If you’re not racking up these hours just yet, Forbes offers a great list of questions to consider while researching a jet card or membership program, or you might consider fractional jet ownership. Companies offering fractional aircraft ownership options typically recommend much higher rates of usage, around 400 to 600 hours per year, before purchasing a private jet. And according to ARGUS International, on-demand charter flights rose 9.2% while fractional-ownership rose 4.7% between 2016 to 2017. So while there are many considerations, the financial goal here is to be flying enough hours to tip the checking book in favor of private jet ownership.Benefits of Buying a Private Jet

We’ve talked an awful lot about money. There’s an important point to bring up, outside of market conditions, fuel prices, and the like.

Four major benefits of private aircraft ownership aside from the financial benefits include privacy, safety, customization, and accessibility.

We’ve talked an awful lot about money. There’s an important point to bring up, outside of market conditions, fuel prices, and the like.

Four major benefits of private aircraft ownership aside from the financial benefits include privacy, safety, customization, and accessibility.

Privacy and Confidentiality

Having your own private jet can ensure a level of confidentiality and security which can make sense from either a personal or business standpoint. Apple CEO Tim Cook is actually legally required to fly private due to security and safety concerns. This situation is common among high-profile business professionals and celebrities.Safety

Maybe you have allergies or want to ensure a completely risk-free environment. You might be concerned about your pet’s safety during flights or be wary of not having the freedom to bring them along with you on flights. Private jets offer you the safety of controlling your surroundings which is important for those with health concerns.Complete Customization

When you own your aircraft, all design and customization options are up to you. You can design your space to suit your needs. Whether having an in-flight workout suite is more important than extra seating or having a full kitchen is a priority over a master bedroom – you call the shots. If you’re one to spend what feels like more hours in the air rather than on land, you’ll want this level of complete customization.

Accessibility

Accessibility is a huge bonus for private aircraft owners or charters. Need to travel to an area without adequate commercial airline services or a major airport? Maybe your vacation home or a client is in an out-of-the-way place? A private aircraft is a perfect solution to remove limitations of accessibility for your personal or business life. Whatever your reason, owning a private aircraft will always supply the greatest opportunity for privacy, comfort, and flexibility. These are the types of preferences that trump most financial considerations.Where Can I Buy A Private Jet?

You’ll want to locate and establish a relationship with a broker who will then be able to guide you through the buying process. Sites like AvBuyer can be used to give you a peek at what is on the market. If you’re lucky, you’ll also be able to get a feel for current pricing standards although many listings will request contact before disclosing the asking price. Other private jet service companies, like Jet Linx, provide a host of services from acquisition to sales and management to jet cards. Opting to work with a company like Jet Linx will help you establish a long term relationship from the purchasing process through the management of your new aircraft, making the transition easier. No matter what you decide to do when it comes to the purchasing process, never go it alone. Always enlist the help of an experienced professional to avoid making a bad purchase that will negatively affect you for years to come.ASSESSING WHICH AIRCRAFT TO BUY

When purchasing an aircraft there are 5 types of jets to choose. The classification is determined by nautical mile range and passenger-carrying capacity:

- Will it be used for business or pleasure?

- How many passengers do you expect?

- What distance do you expect to regularly travel

- Your average business trip length

- Typical passenger number

- Savings from chartering

- Benefits versus cost

- New or used

Could a Private Jet Actually Make You Money?

To offset costs of maintenance and usage of a private jet, private charters are a great option.

It’s important to note that setting up a private charter business is not a piece of cake, but many have found success in offering private charters. And by “success,” we mean not only reducing or offsetting ownership and operation costs, but even making some owners money beyond covering basic expenses.

Cyrus Sigari, the president of Jetaviva, a light jet management company out of LA, has proven it is possible with his clients. Sharing his optimistic take in Business Jet Traveler, he states:

“If the owner is flying 100 hours or less [per year] and the operator has good scheduling control and can utilize the asset, it’s very possible for it to get close to breaking even or even making some money.”

Highlighting that tax depreciation is the “big part of the puzzle” it’s best to identify what your ‘fly-free’ cost point is by first analyzing variable and fixed costs. If you want to go the charter route, the good news is, companies such as Sigari offer charter and jet management where they find clients and handle the chartering for you.

If you are serious about chartering, here are 6 major things to consider as shared by Business Jet Traveler:

To offset costs of maintenance and usage of a private jet, private charters are a great option.

It’s important to note that setting up a private charter business is not a piece of cake, but many have found success in offering private charters. And by “success,” we mean not only reducing or offsetting ownership and operation costs, but even making some owners money beyond covering basic expenses.

Cyrus Sigari, the president of Jetaviva, a light jet management company out of LA, has proven it is possible with his clients. Sharing his optimistic take in Business Jet Traveler, he states:

“If the owner is flying 100 hours or less [per year] and the operator has good scheduling control and can utilize the asset, it’s very possible for it to get close to breaking even or even making some money.”

Highlighting that tax depreciation is the “big part of the puzzle” it’s best to identify what your ‘fly-free’ cost point is by first analyzing variable and fixed costs. If you want to go the charter route, the good news is, companies such as Sigari offer charter and jet management where they find clients and handle the chartering for you.

If you are serious about chartering, here are 6 major things to consider as shared by Business Jet Traveler:

- Find the Right Management Company – One that currently is and will bring in clients and charters.

- End of Accessibility – Customers now have priority and demand is always highest during holidays or times you would use it.

- Location – Your jet will need to be located where charter clients would be, such as major cities or hubs.

- Higher Housing Costs (Potentially) – Relocating your jet to where the demand is greater also means higher hanger costs and competition.

- The Jet Itself – Newer jets are more fuel-efficient, so when selecting a jet to charter, you need to look beyond price.

- The Charters – Longer charters are best to burn off the fuel and reduce costs associated with tankering fuel at multiple locations.

LEASING YOUR JET

If you yourself are a pilot, then chartering your jet is most likely not the best solution. Given the additional cost of hiring another pilot to fly the charter, a better option to look into is hourly leasing or “hourly dry leasing.”

An hourly dry lease is where an owner is paid a flat hourly rate for a lessee to use their jet with the lessee covering costs such as fuel and cleaning.. If you take this option to increase income, you can include yourself as the pilot as part of the lease. Given complexity and liability factors with hourly dry leasing, legal consultation is not just recommended but in many respects required. The National Business Aviation Association created a great overview on what you need to know about aircraft leasing.Reasons Not to Buy

Purchasing a jet is a big investment and decision. A good reference to consider is if you are spending 300 hours or more a year in the air, a private jet is a smart investment. If you are flying less, consider chartering until your needs require a private jet. This was the case with Tony Robbins who was flying privately for over two decades before purchasing his own jet. Many first time jet buyers purchase a jet for the wrong reasons or one with range they will never use. Figuring out what your needs and priorities are first ensures you purchase the right jet to meet but not exceed you needs, saving you thousands or millions.Insure your new aircraft

For informational purposes only.